"In the long run we’re all dead." -John Maynard Keynes

The problem with the long run is that eventually it gets here.

Military planning spans the gamut from large potential near-peer conflicts, to small, asymmetrical engagements across the globe. Lately, the trend is toward thinking about China. Whether it is over the Taiwan Straits, the Spratly Island chain, Vietnam, or North Korea, China is the new pacifier for all the cold-war enthusiasts who pine for the simpler days of bipolarity in the international system.

I’ve argued elsewhere that the notion of fighting a war with China is absurd. What’s more, from a strictly military perspective, there are much more immediate and problematic issues that require greater focus, such as a Mexican failed state on our southern border. But in truth, I now believe that all of that thinking ignores the 600 pound gorilla standing in the room. What planning exists in the military to cope with a collapsed dollar?

One reason I say that the idea of a war with China is absurd is because that war has already been lost. It’s time, once again, for some economics. Let’s start with a number:

14,713,992,331,505.17

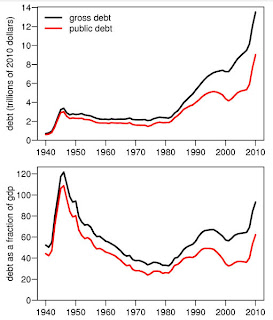

That number, at the time I’m writing this, is our national debt. Let’s have a look at what our national debt has been doing over time (according to the US Govt.):

That debt is currently increasing at a rate of 4 billion dollars PER DAY. Who is lending us all this money? Let’s have a look at who owns our national debt:

China owns seven and a half percent of our national debt, which works out to $1,103,549,424,862.89 (1.1 trillion dollars). Worse yet, oil exporters hold a large portion as well. And just who are these "oil exporters?" Why it’s Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria.

This very morning, Fed Chairman Ben Bernanke announced that the Fed would likely try even harder to lower interest rates, and since short-term rates are pretty much already zero, they’re going to go back to the 1960’s playbook and move short-term securities into longer-term holdings in an attempt to bring long-term yields closer to short-term. What is the point of that? It’s to try and push you, the consumer, into doing one thing: spend your money. For some reason, the Fed and our government have adopted the notion that the only sign of a good economy is people spending money on consumable goods. (As an aside comment, this is what happens when you put cool-aid-drinking modelers in charge of something.)

So take a wild guess what the national savings of the United States is. It’s -619,175,676,960.00 (that’s NEGATIVE six hundred BILLION dollars). There aren’t very many countries out there with negative national savings rates and the bulk of those are third world countries and failed states.

Well here’s where things start to get problematic. As of August of this year, our inflation rate according to our kind and benevolent government was 3.77 percent. Compare that to the ten-year yield on a US Treasury bill which is currently just under two percent, and perhaps you see a problem? If not, let me spell it out for you. If you bought a ten-year T-bill today, when it matures it will be worth less, in real money terms, than when you bought it. In other words, what is going on here is that the Fed and our government are purposely devaluing our currency for the express purpose getting you to consume, using borrowed money, in order to artificially pump up the economy. Do you truly think that can last? Well it can’t. Here’s why.

Let me first talk a little about the inflation rate. What I listed above as the inflation rate is called the "core" inflation rate. That rate of inflation is calculated using a basket of goods and tracing the price of those goods over time. What’s in that basket of goods is much less important than what isn’t: food and energy. Ostensibly, these two items are left out because it is feared that including them would bias the numbers because of short-term price issues. But in reality, including them always makes the rate higher, often much higher, than the core rate, which is the inflation rate that our government chooses to tell us about. In reality, our current inflation rate, accounting for food and energy, is substantially closer to ten percent. This imbalance between inflation and interest rates is why we constantly hear about how the purchasing power of US consumers has actually decreased relative to necessities, even though it has increased relative to other consumables such as electronics, etc. It is also why our currency is being devalued.

So why aren’t we seeing much more severe inflationary effects? The reason is because of trade imbalance. Most of the goods we consume are made in China, which means the money we spend for them go to banks overseas, and are not part of the money circulating in our economy, but rather in someone else’s. This is possible due to the reserve status of the US currency. Foreign nations hold US dollars due to its reserve status, and I’ve already shown you above just how much money that actually is.

Currently there are movements in the international system to move away from the US dollar to some other reserve currency. Chief among the folks wanting to do this are Russia, most of the oil producing nations and, you guessed it, China. So what happens if the US currency is no longer the reserve currency of the world?

Very simple. Nations holding US reserves will seek to spend those reserves in the only place that they can: the United States. Imagine, for a moment, the inflationary effects of a sudden infusion of several trillion dollars into our economy, as foreign nations seek to purchase anything that they can in the US. To put it simply, our economy will collapse under the weight of cripplingly high inflation rates as other nations dump their holdings in US currency, which is to say nothing of the exacerbating effects of "quantitative easing," which the Fed also announced this morning it is considering another round of. When you add to that the reality that US manufacturing has all but disappeared, the ramifications are staggering.

China will have won the war without ever firing a shot. In truth, they already have. All they need do is pull the trigger. Which gets me back to the opening points in this discussion. What plans are being made in the US military to help this nation survive that trauma? I’m fairly certain that the answer is none. The US military industrial complex currently operates under a single over-riding assumption: that the gravy train of the defense budget will never end. I’ve got bad news. It’s about to.

As much as we love our expensive gadgets, they are simply untenable. If the US Military does not start planning on how to remain an effective force using a fraction of their current budget, then they do a disservice to our country.

It is my belief that at this stage it is simply too late to prevent what is going to happen to our economy. It will happen, and it will happen sooner rather than later (and the longer we put it off by artificially propping up the economy, the worse it will be). We need to start planning on how to survive the event, and come out the other end a stronger, more agile, and more fiscally responsible nation. The members of our military take an oath to defend our constitution. It is time for them to do some soul searching over what that really means when the financial status-quo changes drastically for the worse.

By: Jon Compton

Great article Jon. One thing you missed on the Debt though, is that in addition to the US debt, there is about $3T debt between the State and Local governments.

ReplyDelete